Today I’m joined by Digital Container Shipping Association, otherwise known as DCSA.

DCSA is a non-profit organization driving standardization and digital innovation in the container shipping sector. Founded by major ocean carriers, DCSA drives initiatives to make container transportation services transparent, reliable, easy to use, secure, and environmentally friendly. With big-name members including Maersk, Hapag-Lloyd, and Evergreen, they’re on a mission to lead the container shipping industry towards systematic collaboration – and they have the expertise and budgets needed to drive change.

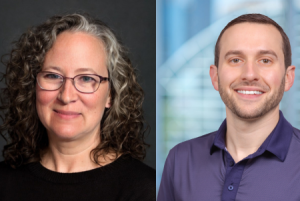

Today, Thomas Bagge, CEO of DCSA, and Thomas Morris, Senior Partner of Global Intelligence at FINN Partners, join me to talk all about a brand-new state of the industry report, commissioned by DCSA and conducted by FINN’s research team. The report is all about digitalization in the container shipping industry, so we’ll be diving into the landscape of the industry, and the sentiment right now when it comes to digital. We’ll be exploring the drivers and barriers to change; current progress, and priorities for the future; and how collaboration can help accelerate the adoption of digital tools.

Guest bios:

Thomas Bagge, CEO at DCSA. Alongside André Simha from Mediterranean Shipping Company and Adam Banks from A.P. Moller – Maersk, Thomas was part of the founding team of DCSA. Before joining DCSA, Thomas led several large-scale change initiatives at A.P. Moller – Maersk, focusing on technology, process optimization, and organizational change. Between 1999 and 2013, he held various international leadership positions in Singapore, Madrid, and Central and Eastern Europe. With over two decades of experience, Thomas has a solid understanding of industry change complexities and working internationally with both governments and global organizations. Thomas holds degrees in Applied Finance and an Executive MBA from Copenhagen Business School (CBS), as well as executive education from IMD and the University of California, Berkeley. He also serves as a non-executive director on several boards unrelated to his role in DCSA.

Thomas Morris, Senior Partner of Global Intelligence, London at FINN Partners. Thomas is a founding member of the EMEA division of FINN Partners’ Global Intelligence team providing a full array of primary research and big data analysis instruments to inform creative platforms, plan communications and marketing campaigns, and measure effectiveness. With over 15 years of experience in strategic marketing communications, he has navigated through numerous industries, from finance to insurance to technology and health, and has planned and executed comprehensive marketing campaigns and communication strategies for nations, multinational companies, and innovative startups. Leading FINN Partners’ office in the UAE, Thomas provides strategic counsel and a full array of PR and marketing services to global clients seeking to access local markets, as well as those in the region looking to improve awareness and reputation abroad. Thomas’ prior leadership roles include heading FINN’s Financial Services division and serving as Managing Director of a London-based financial service PR agency. There, he developed global thought leadership campaigns for finance giants such as Deutsche Bank, S&P Global, Commerzbank, UniCredit, Citi, and Standard Chartered.

IN THIS EPISODE WE DISCUSS:

[06.45] Introductions to today’s guests and what they do.

“DCSA aims to help digitalize and make container shipping more effective. We’re open source and vendor neutral… and our members represent about 75% of the world’s containerized capacity.”

[10.13] An overview of DCSA’s new state of the industry report: what it’s about, why they commissioned it, and what they’re aiming to achieve.

“Decision makers are strongly advocating for more digital tools, more interoperability – they want to improve efficiency… So how do we convert these demands into firm commitments that will help drive digitalization forward?”

[13.41] A closer look at the methodology and analytics that were used in the creation of the report.

“We’re excited. Given the amount of ground we’ve covered, and the amount of research we’ve done – we think it’s one of the most comprehensive reports looking at digitalization within container shipping.”

[17.35] The landscape of digitalization in container shipping, and the historic issues with data, visibility, and interoperability.

“There have been a lot of great initiatives and strides made in our industry… but we need to take the next steps. A lot of those previous digital initiatives were invented in siloes. So, the biggest issues we have today are a lack of data and interoperability.”

[21.32] The current sentiment in the industry towards digital, and whether or not that sentiment was a surprise; and the impact being made by increasing standardization.

“I was surprised by the level of manual interventions that we still see in the industry!”

“86% of cargo owners said that digitalization is a tool that would help improve efficiency and process, and they see the opportunity – we saw cargo owners talk about customer satisfaction, operational costs, and competitive advantage.”

[26.18] The key drivers and barriers to digitalization in the container shipping industry.

“Cargo owners are ready to go, but two thirds said they need help and support. Some are fearful of legacy systems… and there’s also some internal company resistance. We need to get the tech right, but businesses are made of people, and we need to bring them along on the journey as well.”

[30.55] Industry progress, and supply chain stakeholders’ priorities for further change.

“We have a complex industry, there are many stakeholders – this is a problem of a whole ecosystem…. Removing the barriers to trade is in everybody’s interest.”

[36.51] Why sustainability has to be one of the industry’s biggest priorities; how organizations are approaching increasingly stringent regulations and impending ESG deadlines; and how digitalization is going to make a difference.

“The fuel transition is not something that’s around the corner, we’re going to have emissions for many years to come… but the industry can save up to 14% on fuel through collaboration and implementation of just-in-time standards – and that’s work we can do today, we don’t have to wait for 2040.”

[39.23] What DCSA is currently working on to help address key industry priorities, and an example of how they helped a retailer save costs, standardize, and integrate quickly through effective digitalization.

[41.05] How enhanced collaboration can help to accelerate the adoption of digital tools.

“Almost a third of cargo owners talked about hesitancy to adopt new technology solutions before their peers or partners. It’s a classic case of ‘who jumps first?’!”

[43.40] DCSA’s vision for the future of container shipping, and how the industry is going to continue to evolve.

RESOURCES AND LINKS MENTIONED:

Head over to DCSA’s website now to find out more and download the report. You can also connect with DCSA and keep up to date with the latest over on LinkedIn, or you can connect with Thomas Bagge on LinkedIn.

Or you can connect with Thomas Morris on LinkedIn

If you enjoyed this episode and want to hear more about container shipping, listen to 340: Container Confusion: Are Shipping Trends Lost at Sea? with Steve Ferreira, or read The Use Cases and ROI of Container Tracking for Freight Forwarders.

Check out our other podcasts HERE.